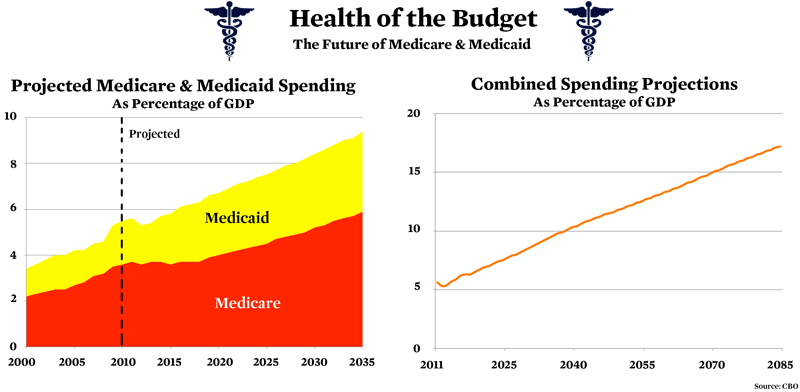

Health care spending in the United States has been growing significantly faster than the national economy for several years, posing serious threats to the solvency of Medicare and Medicaid. The Congressional Budget Office (CBO) projects that federal spending to support Medicare and Medicaid will rise to 12% of the GDP in 2050 and 19% of the GDP in 2082, which, as a share of the GDP, is equivalent to entire sum of current federal spending. This potential increase in spending threatens to contribute to an ever-increasing national debt. In the long term, healthcare spending would decrease investment in domestic capital stock as well as foreign assets, causing economic stagnation.

Confronting the insolvency of Medicare and Medicaid, however, has historically faced significant political roadblocks. As of 2004, Medicare and Medicaid, collectively, covered approximately 87 million Americans. Thus, any decrease in Medicare or Medicaid benefits would have dramatic social consequences. Addressing Medicare/Medicaid reform requires innovative solutions that discourage spending on excessive procedures, limit wasteful spending, promote healthy lifestyles, and potentially mandate more stringent requirements for eligibility and payment.

The Basics

In order to fully understand the Medicare/Medicaid dilemma, it is first necessary to understand exactly who is covered under each program and to what extent.

Medicare is a government entitlement program granting health coverage to people either over the age of 65 or physically disabled, irrespective of age. Coverage is divided into three major components: Part A, Part B, and Part D. Part A offers coverage for inpatient hospital stays, Part B covers many outpatient expenditures, and Part D pertains to prescription drug coverage.

There are certain limitations on the benefits that each part will cover. For example, Part B covers up to 80% of expenditures, and patients are responsible for the remaining 20%. If patients cannot pay this percentage, they may purchase secondary insurance to cover this cost or enroll in a Medicare Advantage Plan which covers the additional cost but places restrictions on coverage. Similarly, in order for someone to receive Part D benefits, the individual must also enroll in a Medicare Advantage Plan or a stand-alone Prescription Drug Plan (PDP). Part D covers the first $500 spent on prescription drugs as well as drugs necessary for catastrophic medical needs, but not in-between costs; this gap is known as the “donut hole.”

While Medicare offers coverage to the elderly and disabled, Medicaid covers individuals with low incomes. Medicare is funded entirely at the federal level, but almost half of Medicaid expenses are funded at the state level. Each state thus operates its own Medicaid system within the confines of certain federal guidelines. The percentage of the cost that the federal government assumes for Medicaid is dependent on each state’s per capita income. The wealthiest states are reimbursed for only 50% of their Medicaid funds from the federal government while poorer states receive a greater percentage.

Causes for the Funding Crisis

The CBO notes that healthcare spending increases reflect “higher costs per beneficiary” rather than an expanding number of beneficiaries due to an aging population. The rising costs of Medicare and Medicaid stem from two main healthcare phenomena. First, new scientific developments in the biomedical industry have made new—and often more expensive—technologies accessible to the general population. As Professor Mary Ruggie of the Harvard Kennedy School told ARUSA, “We have seen a steady increase in health care costs over the past few decades…It is generally agreed that the reason for the rise in health care costs is the widespread use of new technology, both diagnostic and treatment technology.” However, newer technologies are not necessarily more effective in diagnosing patients, and thus are often overused. Mary Ruggie explains, “Just because health care costs a lot doesn’t mean it’s good for you.”

Second, current pre-existing incentive structures for patients and doctors encourage the excessive use of diagnostic and treatment technologies. For doctors, the rising costs of medical malpractice are enough incentive to request extra exams and tests. Moreover, payments to doctors are generally “fee-for-service”: there is no limit on the number of tests for which doctors can be reimbursed through Medicare Part B. According to Joshua Benner, Fellow at the Brookings Institution, “This encourages [service] volume rather than [service] quality.”

Similarly, patients buy into the “more is better” ideology and have few qualms about using more resources. Michael Cannon, Director of Health Policy at the Cato Institute, points out in an interview with the ARUSA, “Medicare and Medicaid are open-ended entitlements that have no limit on how much you can spend. Underlying the causes [for the rising cost of healthcare] is the fact that we’re spending someone else’s money. There’s never enough when you’re spending someone else’s cash.”

Changing the Incentives

Because sustaining Medicare and Medicaid is a multi-faceted problem, a one-dimensional solution will be insufficient. An effective approach will employ many different approaches.

An obvious part of the solution involves placing stricter requirements on eligibility and/or placing more limitations on which services Medicare and Medicaid will fund. But employing this approach alone would only shift the responsibility of funding from the federal government to individuals and households. Moreover, as Michael Cannon notes, “If government pushes prices too far down, then doctors won’t take patients at that price. Thus, there is strong political pressure to keep payments high, especially in Medicare, as opposed to Medicaid, because seniors have more clout.”

Therefore, it is widely recognized that solving the Medicare/Medicaid crisis will to some extent involve changing the medical incentives of doctors and patients in order to lower healthcare costs overall, rather than solely targeting Medicare/Medicaid. This can be done in a number of ways. For example, making information on the comparative effectiveness of different treatments more accessible may prevent physicians from utilizing costly services when clinical benefits have not been fully demonstrated. As Professor Anirban Basu at University of Washington tells ARUSA, “I think it is most important that we support research on which drugs help which people so that we can target drugs effectively and get more bang for our buck. In most cases, the value of this research is quite high and the cost of research is quite low.” Professor Ruggie suggests that pharmaceutical advertising should be more tightly regulated in order to stop perpetuating the notion that “new” is inherently “better.”

Additionally, the government can discourage excess costs in Medicare by tying payments to the efficiency of treatment. Another means to limit the incentives to order more tests is to increasingly bundle payments associated with a particular condition or diagnosis rather than pay doctors additionally for each treatment or diagnostic they use. On the patient side, Medicare could require patients to pay for the additional expenses associated with less effective treatments.

Current State of the Debate

While most of these proposed reforms have yet to be implemented, the recently passed Patient Protection and Affordable Care Act (PPACA) does begin to address some issues related to Medicare and Medicaid funding. According to the Economic Report of the President, the PPACA does attempt to decrease fee-for-service payments by 50% by the year 2012. This means, as Ruggie puts it, “rewarding providers for the kinds of things that are both effective and cost saving and penalizing them for things that are ineffective and costly.” For example, hospitals used to be paid for preventable readmissions such as a readmission of a patient due to a disease he acquired at the hospital; under the PPACA, the government would no longer fund these readmissions. The PPACA also attempts to maintain current standards of care in spite of fiscal difficulties, at least temporarily, by shrinking the donut hole and preventing an imminent decrease in physician payments as a result of the Sustainable Growth Rate (SGR).

However, some suggest that applying these fixes to the system while maintaining the same basic structure of Medicare is not enough to control explosive spending. In light of this, Representative Paul Ryan proposed giving individuals vouchers that would be sufficient to purchase a basic insurance plan while allowing them to opt to pay more for increased benefits. This approach changes the incentives for the patient who, as Michael Cannon notes, “can limit wasteful expenditures, and see the savings” because it “allows patients to decide how to limit their own medical expenses.”

Some argue that this solution may be unsustainable as private health insurance costs have been increasing faster than Medicare/Medicaid costs. Addressing this issue, policymakers suggest opening up state borders to increase competition between health insurance companies, driving down overall insurance costs. But Ruggie worries that “When people control their own expenditures on healthcare, they don’t spend as much, and they don’t know what to spend it on,” allowing the possibility that health outcomes could become worse as a result.

While policy differences abound on healthcare spending, the problem of rising Medicare/Medicaid costs is, according to the CBO, essential to resolve in order to maintain the United States’ debt to GDP ratio. Moreover, ensuring the solvency of Medicare and Medicaid is crucially important to prevent the number of uninsured Americans from rising even above the 50.7 million most recently reported by the Census Bureau. If we neglect to compromise on policy differences and apply multiple solutions, the generation-old promise of affordable healthcare may be lost for millions more.

Design by Andrew Seo