It is often said or assumed that Social Security is headed toward bankruptcy. A recent Gallup poll showed that 60 percent of American workers do not believe Social Security will be able to pay them benefits when they retire. Yet for over two decades, no significant changes have been made to the federal entitlement program on which retirees depend for over 40 percent of their income. Reforming the system is necessary, but claims that it faces imminent bankruptcy are exaggerated. Policymakers should act sooner rather than later, but the problems facing Social Security can be solved relatively easily if political obstacles can be overcome.

Social Security: The Basics

The Social Security Administration was established in 1935 as part of President Roosevelt’s New Deal. While it originally provided retirement compensation for workers in the commerce and industry sectors and excluded the vast majority of women and minorities, it now covers almost all retired and disabled workers as well as surviving spouses and children of deceased retirees. In 2010, Social Security paid $695 billion in benefits—19.6 percent of the budget—making it the single largest federal expenditure.

The Social Security Administration was established in 1935 as part of President Roosevelt’s New Deal. While it originally provided retirement compensation for workers in the commerce and industry sectors and excluded the vast majority of women and minorities, it now covers almost all retired and disabled workers as well as surviving spouses and children of deceased retirees. In 2010, Social Security paid $695 billion in benefits—19.6 percent of the budget—making it the single largest federal expenditure.

To finance this massive program, the federal government imposes a payroll tax on the workforce. Employees surrender 6.2 percent of their earnings below an inflation-adjusted cap, which is $106,800 as of 2010; earnings above this amount are exempt. While employers contribute a matching 6.2 percent of their employees’ wages, economists generally agree that this cost is passed on to employees in the form of lower wages. Self-employed workers subtract the full 12.4 percent tax from their income, though the employer’s share is tax deductible.

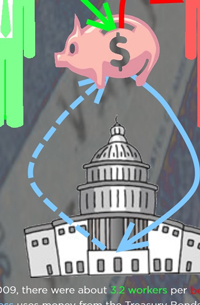

Social Security is a pay-as-you-go, or “PAYGO,” program, meaning payroll taxes are not put into personal accounts for workers when they retire. Instead, revenue collected today goes into a Trust Fund that pays benefits to current retirees. Generally, a retiree is eligible to receive full Social Security benefits only if he paid into the system for at least ten years, and only if he has reached the retirement age, which varies from 65 to 67 years depending on date of birth. While the average retiree received $1,164 per month in 2010, benefits vary substantially since they are indexed to how much a retiree paid in taxes during his 35 most productive years; higher income earners, in other words, draw greater benefits.

Headed Toward Bankruptcy?

Most of the concern over Social Security’s long-run solvency stems from the decreasing number of workers paying into the system for each beneficiary. Thanks to increasing life expectancy and the retirement of the Baby Boom generation, the ratio of workers paying taxes to retirees receiving benefits has decreased from 8.6 in 1955 to 3.2 today, and the SSA estimates it could drop as low as 2.1 by 2031. Social Security is currently running a deficit—about $29 billion in 2010—thanks to the recession. While it is expected to begin running a surplus again soon, the SSA predicts it will run annual deficits beginning around 2016 unless Congress changes the current benefit or taxation scheme.

That in and of itself, however, is no cause for alarm. Christian Weller, a fellow at the Center for American Progress, explained to the HPR that while Social Security “will experience a cash deficit, this deficit was expected.” It’s why Congress passed a payroll tax increase in 1983 to generate more revenue than had to be paid in benefits each year. This annual surplus has accumulated in the Social Security Trust Fund, the balance of which—currently at about $2.4 trillion—will be used to pay beneficiaries once the program starts running a deficit. The Congressional Budget Office estimates that the Trust Fund will be able to pay full benefits through 2039.

While Baby Boomers’ retirement will stretch Social Security thin, the long-term demographic forecast bodes relatively well for the program’s solvency. Ronald Lee, a professor of demography and economics at the University of California, Berkeley, told the HPR that Social Security is a “smaller problem” in the United States compared to other countries. According to Lee, the United States is at about replacement-level fertility, meaning every woman gives birth to an average of about 2.1 children. In Japan, South Korea, and much of Western Europe, this figure is significantly lower—around 1.0 in some nations—meaning there will be a smaller future workforce to finance the retirement of current workers. So while those countries face a looming pension crisis, the United States, Lee thinks, can save its system with a few tweaks.

The Fix

Most experts agree that policymakers have three options to strengthen Social Security. Congress can increase the payroll tax, reduce benefits to retirees, or augment the Trust Fund by investing a portion of it in equities. According to the CBO, a 1 percent increase in the payroll tax would increase the life of the Trust Fund to 2056, and a 2 percent increase, implemented gradually over 20 years, would make the Trust Fund solvent through 2083. Removing the payroll tax cap would extend the life of the Trust Fund to 2083, and taxing up to 90 percent of income would sustain it until 2050.

On the benefits side, raising the retirement age is one of the most common and feasible proposals. In 1983, Congress implemented a retirement age that increases according to date of birth, culminating in 67 years for all citizens born after 1960. A further increase alone may not sufficiently improve solvency, but in the long run the CBO estimates that raising the retirement age to 70 could reduce benefit outlays by 6 percent.

Some believe the effects of these strategies could be augmented if Congress changed the way it manages the Trust Fund. The surplus could potentially earn more interest if it were invested in stocks, it is argued, since they have historically outperformed government bonds. This strategy entails risk, of course, and might have trouble garnering political support given its association with President George W. Bush’s failed campaign for private Social Security accounts and recent stock market volatility.

Ensuring the solvency of Social Security is entirely possible; the only obstacle is a lack of political will. As Dr. Weller explained, the “easy Social Security fixes” outlined above are “politically incredibly controversial.” While conservatives and anti-tax groups scoff at payroll tax increases on the grounds that taxes are already too high, senior citizens and allied interest groups including the American Association of Retired Persons virulently oppose benefit cuts, and large segments of the population oppose both ideas. Thus Congress remains at an impasse, attempting to find the least unpopular combination. Focus on issues like health care, energy, and financial regulation have relegated Social Security to the backburner, and ideas currently under discussion are very limited in scope.

Time is on our side for now, but the situation is steadily worsening and will accelerate as the Baby Boomers begin to retire beginning next year. The sooner Congress arrives at a solution the better, since every passing year renders the necessary tax hikes and benefit cuts more severe.