First called the “third rail” of American politics by Speaker of the House Tip O’Neil in 1981, Social Security remains one of the most divisive programs in our budget. Add the fact that it is the single largest expenditure by the federal government, and its sheer size prevents Washington from reaching reform or compromise year after year. In fact, the last serious change to the program, a series of amendments that increased the retirement age and made certain benefits taxable, to, ok place in 1983.

But the Congressional Budget Office warns that Social Security “will become insufficient to pay full benefits in 2039,” and in 2010, for the first time, the program paid out more benefits than it collected in tax revenue. Abruptly cutting so large and complex a program is politically risky, especially in the current economic climate. While Congress must enact changes to the program must to ensure its long-term solvency, some question whether Social Security poses an immediate threat to the United States’ current fiscal situation.

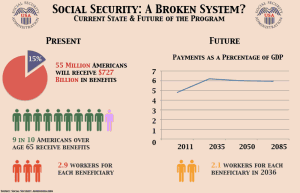

Social Security by the Numbers

President Franklin Delano Roosevelt established the Social Security Administration with the Social Security Act of 1935. Originally intended as a strict insurance program, it soon grew to provide assistance to almost all retired persons (through Old-Age and Survivors Insurance, or OASI, benefits) and disabled workers (through Disability Insurance, or DI, benefits). The program administers its own payroll tax which it uses to finance benefits; all American workers must pay 6.2 percent of their income—up to $108,600—into the program, which is matched by their employer. In 2010, when payroll taxes did not cover total expenditures for the first time, the government made up the difference by withdrawing from the Social Security Trust Fund, an account accumulated over many years of surplus and interest. The Trust Fund currently holds around $2.6 trillion, enough to last, by the CBO’s estimate, into the late 2030s.

In FY 2010, Social Security benefits totaled about $708 billion, or roughly one-fifth of the federal budget. By comparison, both the Iraq and Afghanistan wars have cost just over $1.2 trillion in their entirety; Social Security’s outlays easily exceed this in just two years. While Social Security was initially intended to lift millions of seniors out of poverty—a goal it has ostensibly achieved—the program does not now distinguish between persons based on their financial situation. Almost everyone who has paid taxes into the program for ten years and is at the retirement age—currently set at 66 but which will increase to 67 over the next fifteen years—is eligible for benefits under the current system. According to the Social Security Administration, the average monthly benefit for a retired worker is currently $1,177, or just over $14,000 each year.

In the Red?

Social Security’s status as the largest federal expenditure, along with its long-term fiscal insolvency (largely due to demographics), makes it a popular target for policymakers who want to lower spending and balance the budget. Andrew Biggs, a scholar at the American Enterprise Institute and deputy commissioner of the Social Security Administration under President Bush, explained to ARUSA that “Social Security is sort of like Texas – everything about it is big. It’s the biggest tax that most people pay; it’s the biggest source of income for most people in retirement.” So reform is difficult to implement, and frequently phased in over many years. Biggs is concerned that “we’ve pushed things too long and they will be difficult to fix,” with respect to Social Security, Medicare, and Medicaid

Others disagree with this critical assessment and the related cost-cutting approach to reforming Social Security. The American Association of Retired Person’s (AARP) Legislative Affairs Liaison David Certner reminded ARUSA that “Social Security is a separate, off-budget program. It is separately financed…from the rest of the United States budget.” Certner takes issue with including Social Security in the current deficit reduction talks because the program doesn’t directly contribute to the national debt. While payroll taxes were not enough to cover benefits this year, he explained that “bonds from the Trust Fund are also paying interest to Social Security, so the combination of payroll taxes plus the interest on those bonds is far more than is needed to pay benefits, and the trust funds are continuing to grow.” By Certner’s estimation, Social Security is currently very much in the “black.” Of course, given the CBO’s projections, Certner wants to pursue reform to ensure the program’s future sustainability, but not by cutting benefits to make up the budget deficit or pay down debt.

An Aging Population

The primary contributor to Social Security’s long-term insolvency is America’s aging population. In 2010, the first members of the Baby Boomer generation began to retire, marking the beginning of an era when an unprecedented amount of people will become eligible for benefits. Unlike countries like Japan and China, where the average family has only one child, American families have on average 2.1 children, meaning the replacement rate is stable. Yet according to the Administration on Aging, the number of persons 65 years or older in the U.S. will nearly double in the next twenty years. This is mainly due to improved healthcare, which allows seniors to live longer, and rising immigration rates. For these reasons, and because current taxpayers pay for today’s seniors rather than each person paying into his or her own personal account, Social Security will soon begin to run permanent deficits.

Political Obstacles and the Future

Social Security will continue to pay full benefits through the payroll tax and the

Trust Fund for over 20 years, but Congress should work toward a new reform measure to strengthen the program. Acting sooner rather than later allows changes to be phased in, meaning current retirees will not be disproportionately impacted by a sudden change in their benefit statement. For instance, the retirement age was raised from 65 to 67 in 1983, but phased in over a period of nearly thirty years.

Yet reform remains as politically unpalatable as ever. One reason why cuts to Social Security are a poison pill for American politicians is that retirees can precisely measure how much money they lose. Biggs explains, “If we reduce your Social Security benefits, you can calculate down to the penny how much money you’ve lost. You get a benefit statement from the government each year, and the number on that piece of paper goes down.” Healthcare, on the other hand, represents a much less tangible service; the government can reduce funding for Medicare while claiming to make up for the loss with an improved system through new technologies or preventative care.

The CBO explains that there are five primary mechanisms to reform Social Security and ensure it can pay benefits in future years:

- raising the retirement age,

- increasing the payroll tax,

- cutting benefits,

- increasing the benefits for low earners at the expense of others,

- reducing the cost-of-living adjustments applicable to current benefits.

Congress has also proposed other reforms. Paul Ryan’s budget proposal, supported by most Republicans as a fiscally responsible plan, would partially privatize Social Security, allowing workers to “begin contributing to personal accounts…as these personal accounts continue to accumulate wealth, they will eventually replace the funding that comes through the government’s pay-as-you-go system.” This plan would eliminate part of the progressive benefit structure of Social Security, which redistributes wealth very slightly between high-income workers and low-income workers.

But does Social Security too heavily aid Americans who least need its benefits? Biggs feels we’ve sidestepped the original purpose of Social Security—alleviating poverty for retirees. One of the core tenets of Biggs’ comprehensive deficit reduction plan includes “a benefit increase to one-third of the people in the system, and a benefit cut to two-thirds [of recipients], so everyone is protected against poverty, but you’re not getting much more than that.” His reasoning is that “paying benefits to high income people is not the highest priority; giving a more solid safety net is the highest priority.”

In some respects, cutting Social Security is to Democrats as raising taxes is to Republicans. In recent budget talks, the GOP called any tax increase “off the table,” and Democrats did the same for the prized entitlement program. It’s likely that we won’t see major reform before the next election cycle, but that in and of itself is not cause for immediate concern. What is concerning, however, is the notion that Social Security is somehow “taboo,” as politicians identify it as “off limits” during debates. Solutions such as changing the benefit structure to a more redistributive model or raising the payroll tax by just a percentage point will easily extend the life of the Trust Fund by twenty years, yet policymakers consistently fail to find common ground. Some are frustrated that these solutions constitute “band-aid fixes,” and others are worried about the immediate effects of cuts on retirees.

Social Security has played a major role in lifting millions of American seniors out of poverty and it remains the cornerstone of the national safety net, but change is necessary. Unfortunately, the obstacles to reforming Social Security are almost entirely political, and while crisis is not imminent, Congress should take measures sooner rather than later to ensure Social Security’s viability well into the next century.

Design by Andrew Seo