Balancing Growth with Fiscal Responsibility

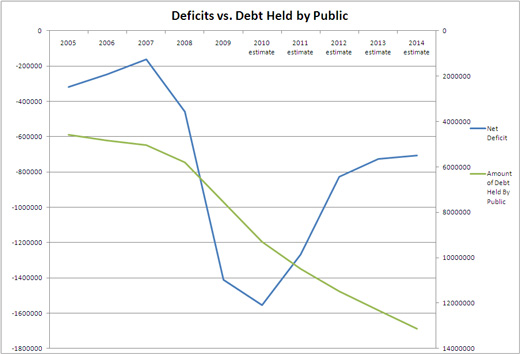

Ten years ago, the nation’s future fiscal health seemed assured: an economic boom and the lack of significant external threats created budget surpluses. In 2001 the Congressional Budget Office (CBO) even projected that over the next decade the nation would enjoy a $5.6 trillion surplus. Politicians gleefully debated how to best utilize the windfall, ultimately … Read more