In its race to beat its global competitors, China has quickly become the largest non-traditional contributor of aid to sub-Saharan Africa. In contrast to the West, which prioritizes public health and education when giving aid, China focuses on granting loans to fund physical infrastructure construction. In 2015, it provided around $14 billion in such loans to African nations. These infrastructure loans have been quite effective at producing observable results—building Africa’s first electrified cross-border railway in Ethiopia, hospitals in Zambia, mines in Namibia, and more.

China is often purported to offer “no strings attached” loans, compared to the aid offered by its Western counterparts that often come with stipulations on human rights, equality, or even economic privatization. However, a closer examination of Chinese loans reveals that they are far from fair and altruistic. China rewards political loyalty: countries that are more likely to vote on China’s side in the U.N. General Assembly receive 86% more developmental assistance. In addition, the enormous repayments African nations owe China after the construction of infrastructure will likely leave them massively indebted, both monetarily and politically.

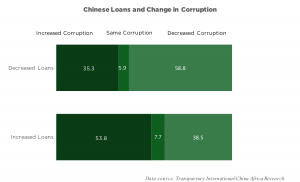

Especially striking is the relationship between Chinese loans and corruption. The graph below shows correlation between changes in Chinese loans and changes in corruption in Africa, measured from 2012 to 2015. Notably, the majority of nations that received more in Chinese loans in this period also experienced increased levels of corruption, while the majority of nations that received less in loans saw decreased corruption.

This correlation is not overly surprising. Compared to other international aid programs, Chinese loans focus heavily on propping up existing government regimes. Although these regimes are not initially more corrupt than the recipients of Western aid, Chinese loans tend to push them towards increased corruption. Receiving loans removes political and economic obstacles for state repression, which in turn increases the incentive and ability to carry out corrupt practices. Chinese loans are also disproportionately allocated to the hometowns of African leaders, which makes it easier for officials to manipulate projects for political gain. Empirical research from AidData confirms that localized corruption increases around the site of Chinese development projects.

Such practices benefit Chinese interests abroad. Because Africa is home to many up-and-coming economies, supplying loans and currying favor with African politicians benefits Chinese foreign policy and diplomatic relations in the long run. The upshot of increased corruption is both inevitable and extraneous to China’s end goal.

Not only do Chinese loans tend to push African leaders towards corruption; they also corrupt the democratizing effect of other aid programs. Because recipient countries of Western aid can now turn to China as an alternative, Western aid has become far less effective at pushing Sub-Saharan African nations towards democracy. Moreover, donors like the World Bank substantially decrease the amount of conditions attached to their loans when lending to nations that also receive Chinese aid, which further reduces the democratizing impacts of Western aid.

In theory, helping others in need always sounds like a good idea. In practice, foreign aid is often messy. While both Western aid and Chinese loans have their pitfalls, China’s ploy to win over African leaders, regardless of its consequences, leads to increased corruption in recipient nations. Although China ignores its ties to corruption today, if this corruption provokes instability, the world may not have the same luxury in the future.

Image Credit: S1951023/Wikimedia Commons