Climate change poses one of the most serious threats to the United States and the world. However, Democrats and Republicans have yet to agree on a solution, or whether there should even be one. For years, advocacy groups have endorsed a carbon tax plan intended to curb fossil fuel emissions, the driving force behind climate change. These proposals typically combine a tax on carbon dioxide emissions with dividend distribution, funneling the billions of dollars generated by the fee back to households to encourage economic growth. Various plans along these lines have garnered support from people like Al Gore to Exxon Mobil CEO Darren Woods. So why isn’t this the bill Congress is fighting over today?

The Citizen’s Climate Lobby, a climate change advocacy group, lobbies for a “Carbon Tax and Dividend” plan to tax carbon dioxide emissions. Initially, the plan would tax at a rate of $15 per ton, with an increase of $10 per ton each year. The group also supports distributing the tax revenue back to American families, an annual stipend which would start at around $50 for a household of four. This plan also includes a tax on imports of “Carbon-Intensive Goods” from countries with more lenient carbon tax policies in order to discourage companies from relocating to countries that allow more fossil fuel emissions.

Regional Economic Models, Inc. is a nonpartisan group which provides economic analysis for both energy companies and governmental agencies. In 2014, REMI studied the economic impact of a carbon tax that follows the CCL’s plan. REMI estimated that the policy would produce 2.1 million jobs by 2025, and 2.8 million by 2035. However, the study also found that the policy would not have a significant effect in the region containing Texas, Louisiana, Oklahoma, and Arkansas, states in which fossil fuels compose a significant portion of the job market.

Congress members from oil and coal-heavy states may hesitate to support a bill which would hurt the oil and coal industries they rely on. However, if states work to diversify their energy resources, they can, in turn, strengthen their economies. As many fossil-fuel dependent states now exist, the economy would suffer should the fossil fuel market decline more than it already has. This carbon tax plan will help these states build more stable, reliable economies.

Regardless of the market activity, oil resources, at least, will be scarce in the near future. In 2016, British Petroleum Inc. determined that if oil is produced at the 2016 rate, world oil reserves would last about 50 more years. The carbon tax would force producers to shift towards renewable resources, so companies would invest less in fossil fuels, a market which will decline in the next half-century.

As the U.S. Department of Energy says, “a clean energy revolution is taking place across America, underscored by the steady expansion of the U.S. renewable energy sector.” A study by the U.S. Energy Information Administration projects growth for over 40 years in renewable energy sources, while oil and coal industries would remain constant or decline. A carbon tax plan would push producers towards clean energy, a necessary change if the United States is to expect consistent economic growth in the future.

With a goal of bipartisan collaboration on climate change solutions, the CCL has made significant progress over the last few years. In addition to rallying support for the Gibson Resolution, a pledge to create solutions to climate change, the CCL recently established the Climate Solutions Caucus in the House of Representatives.

“Carbon Fee and Dividend” plans like that of the CCL have gained bipartisan support because they don’t increase the government’s size or revenue, but instead feed tax dollars directly back into the economy to support the middle class and create jobs.

In February, a group of conservatives led by former Secretary of State James A. Baker III proposed a climate change solution that garnered support from Democrats, including Al Gore, as well as energy giant Exxon Mobil. Despite Baker’s refusal to recognize the man-made causes of climate change, he still acknowledges the threat it poses to the United States. The plan that Baker and several other conservatives put forth included a “Carbon Fee and Dividend”, which would tax carbon dioxide emissions and provide a dividend to American households, similar to the CCL’s plan. However, Baker and his collaborators upped CCL’s fee to $40 per ton of carbon dioxide and estimated that every year $2,000 would be given back to each household of four.

Despite its wide spectrum of supporters, many still criticize the effort. In a USA Today op-ed, Thomas Pyle, president of the Institute for Energy Research, sourced his criticism from a fear of taxing carbon, a basic commodity of American life. Pyle stated that we need affordable and reliable energy to survive.

However, the purpose of Baker’s plan is not to rid the country of reliable energy. The tax aims to decrease carbon dioxide production, but also to make room for more efficient, sustainable energy sources. Even now, solar jobs outnumber those in coal, and are multiplying at a rate 12 times faster than the U.S. economy.

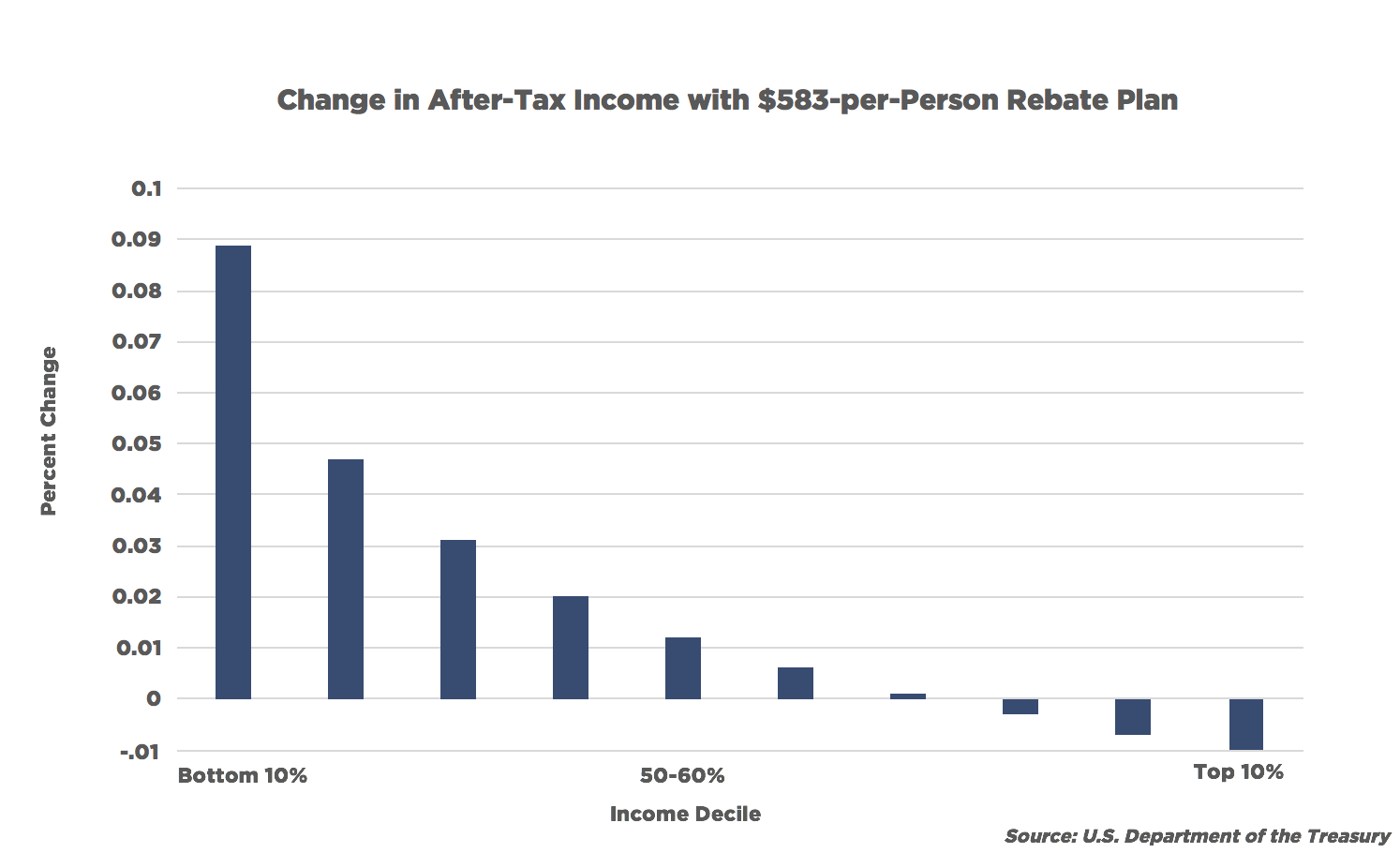

As with any other tax plan, questions persist about its effect on the economy. For example, a tax plan which charges each household equally regardless of income would disproportionately affect low-income households. One thousand dollars means much more to a low-income family than an affluent family. However, in January, a Department of the Treasury report found that Baker’s plan, if coupled with a $583-per-person rebate, would instead benefit the bottom 70 percent of Americans with varying degrees of percent income gain. Still, the percent income loss of the top 30 percent of Americans would be minimal.

While many fear imposing taxes to fight climate change, this tax would be coupled with massive growth in renewable energy and American jobs. Nevertheless, progress has halted on Capitol Hill. Despite the bipartisan nature of the plans foregrounded by Baker and the CCL, meetings between these groups, the Hill, and the White House have made little headway since January.

It would seem that the congressional supporters of President Trump and his “America First” rhetoric would approach such a promising, pro-growth plan with an open mind. Yet, many Republicans in Congress and the cabinet seem so wedded to oil and coal companies, that they would favor the fossil fuel industry over the American economy as a whole. Furthermore, many deniers of climate change are so opposed to green initiatives that they refuse to consider a plan that aims to diminish America’s carbon footprint, despite the economic benefits.

The “Carbon Fee and Dividend” plan, in whatever form it may take, can make significant and necessary change in this country. As the climate worsens, the world is moving towards clean energy. However, pro-green Democrats and free-market Republicans’ failure to agree on climate solutions has prevented the United States from making that transition. This plan may be the only one circulating Washington D.C. which can satisfy both environmental advocates and laissez-faire capitalists alike.

Image Credit: Flickr / Nattu Copyright 2.0