Already, we have begun to distrust and be more skeptical of our society’s so-called experts — people whose academic or professional credentials are associated with places like Harvard and put them at the top of their field. However, even some of the strongest skeptics might be surprised at the magnitude of incompetence demonstrated by experts during the ongoing coronavirus pandemic. Commentators have already noted the disastrous failure of medical officials at the World Health Organization, which — among other things — led the world to drastically underestimate the threat of COVID-19 in its early stages. But another group of experts has reason to be especially ashamed in the wake of this crisis, too: economists.

Economists and others have noted that economic phenomena are prone to wild swings, that seemingly unthinkable economic outcomes appear unexpectedly often. In the jargon of statisticians, these phenomena can be said to come from “fat-tailed distributions,” and these unlikely but hugely consequential events are called “tail events.” Given this radical uncertainty in our economic life, economists should have advocated for an economy that is robust to tail events. However, instead of making our economy more resilient, economists have insisted on optimization by globalization, which has made supplies of critical goods vulnerable to the unexpected. Moving forward, we cannot prioritize peace-time efficiency at unbounded cost during crises, and we cannot outsource the production of vital medical supplies abroad to countries like China.

Fat Tails and Economics

What are “fat-tailed distributions” and how do they connect to real-life phenomena? In probability theory and statistics, a probability distribution expresses the respective probabilities of certain events. One distribution you may be familiar with is the normal distribution — the famous “bell shaped” curve. Heights are said to be normally distributed such that you are most likely to be a height close to the average and then progressively less likely to be a height as it varies from the average. The normal distribution is said to have thin tails because the tails of the distribution — probabilities far from the average — get very small very quickly. For example, you would not expect anyone to have a height of more than 15 feet; the probability of having a height so far from average is essentially impossible with a thin-tailed distribution. A fat-tailed distribution, however, assigns small but nevertheless significant probabilities to outcomes far from the mean. If height’s probability distribution had fat tails, most people would be around average height, but every so often (maybe once in every five years) you would find someone who was as tall as 100 feet.

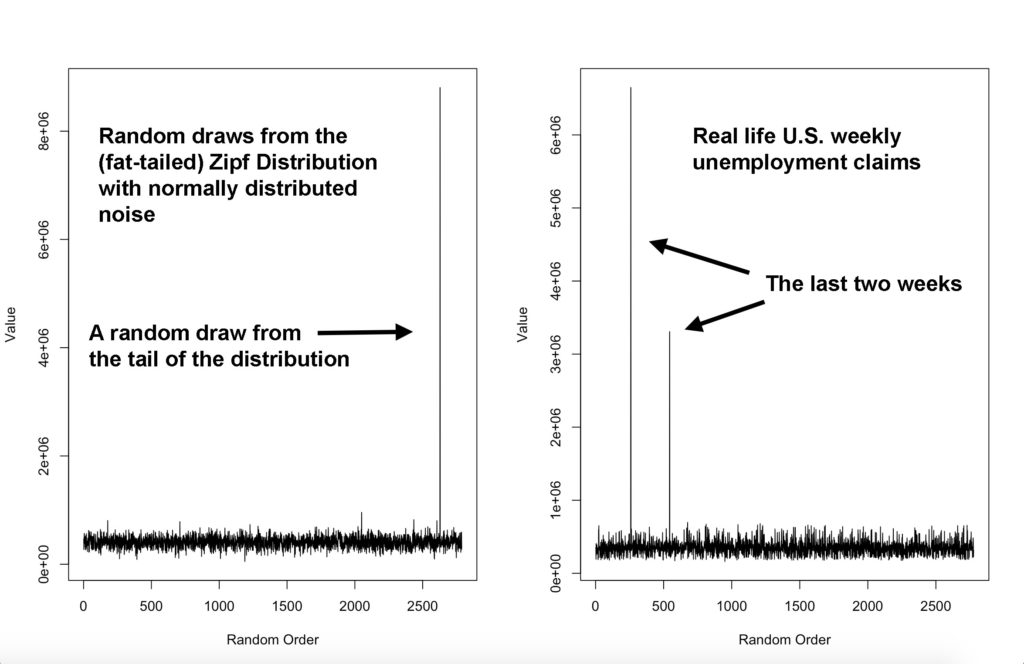

If heights are distributed with thin tails, what things are distributed with fat tails? It turns out that most phenomena that we care about are fat-tailed — including those in the economic realm. Take a look at unemployment data and compare it to draws from a fat-tailed distribution:

Financial markets have demonstrated their fat-tailed nature on a few occasions in the past, most notably in 1987 when the Dow Jones Industrial Average crashed more than 20%. It was an outcome that you would not have guessed would happen in more than a billion years if you were modeling the stock market with a normal distribution, which many people were doing and have continued doing since then.

Financial economists did not all learn from 1987. The Gaussian copula was a model for pricing certain kinds of mortgage securities used by many before 2008, and it relied on the normal (or “Gaussian”) distribution. As a paper from the University of Oxford points out, “The Gaussian copula approach cannot model tail dependence. Therefore, the probability for the simultaneous default of a great number of borrowers were totally underestimated.” In other words, the model completely broke down under the circumstances surrounding the subprime mortgage crisis, and its use was one of the most important factors contributing to the 2008 financial crisis.

The scary part about fat tails is that they take a long time to show themselves. But we, financial economists and beyond, can learn from our mistakes: If we had tried to model weekly unemployment with a thin-tailed model without these past weeks’ data, we would have completely excluded the possibility that something like the COVID-19 crisis could ever happen. If we instead recognize that financial markets have fat tails, perhaps we could have better prepared for this pandemic.

From Ricardo to Navarro

The economist David Ricardo developed a theory of comparative advantage in 1817 that advocated for specialization in international trade. With an example of the trade of cloth and wine between England and Portugal, Ricardo explained analytically how it is more efficient for countries to produce distinct combinations of the two goods and trade with each other rather than for the countries to produce all goods domestically. This fact holds even if one country has more efficient production of both goods. This analysis is the essence of most economists’ current position on international trade.

There is one economist who has been skeptical of this view due to the security risk that outsourcing presents to the United States. His name is Peter Navarro, and he is President Trump’s Director of the Office of Trade and Manufacturing Policy. Navarro received a PhD in Economics from Harvard University, but he is not well respected in his field; an economist from Carnegie Mellon said of him, “he doesn’t do research that would meet the scientific standards of [the academic] community.” Navarro is the author of Death By China, which argues that China has cheated the international system and that the United States must bring jobs home for national security reasons. Navarro has recently been featured during President Trump’s coronavirus press conferences. While Peter Navarro has often been mocked, the coronavirus pandemic has proven that his position is absolutely correct.

The Necessity of Redundancy

Nassim Taleb said of economists that they would have designed humans to have one lung and one kidney because the extra organs are most often deadweight. Of course, we are given two of these vital organs in the case that something terrible happens to us. Similarly, we cannot over-optimize our economy. It may be theoretically more efficient to produce certain things abroad, but the real world has fat tails. Once in a while, crazy things happen: supply chains break down, we go to war, or we have an unprecedented pandemic. In preparation, our economy should be set up to be as robust as possible.

We must have the capacity to produce vital medical supplies in the United States. Currently, China makes 97% of antibiotics used in the United States, which makes us tremendously vulnerable to the whims of the Chinese government. We cannot be dependent on China for our welfare or for our physical security, because there might come a time when we do not do business together, whether because we are at war or because our international supply lines break down. Redundancy means that we have reserves; it means that we are prepared for tail events. Our country is in recession, and millions of people have filed for unemployment. If our economy cannot withstand a pause of a few weeks, we have an economy that is far too fragile for the fat-tailed nature of real life.

Recognizing that our markets are fat-tailed has implications for our trade relationship with China. I choose China to pick on because they are our biggest trade partner, they engage in unfair trade practices, and the virus first appeared within their borders. Their lies have delayed the global response to this crisis, contributing to deaths across the world. Meanwhile, China’s factories profit by accepting checks from governments around the world who are scrambling to deal with the virus. For the time being, we must depend on China to send us supplies from the factories that it has, in effect, stolen from the United States. In the long run, however, the current market equilibrium is inefficient. Once this crisis is over, we must bring our manufacturing of critical goods back home to the United States, even if such production appears costly the majority of the time.

Image Credit: Wikimedia Commons / Ahmad Ardity