In his April 11 post, “Weighing In: The Great Tax Debate,” Max Novendstern rebuts my most recent argument that it is inappropriate for 73 percent of federal income taxes to be paid by 10 percent of the American population. Since our disagreement is to at least some extent based on our differing conceptions of fairness, I will offer only a partial response.

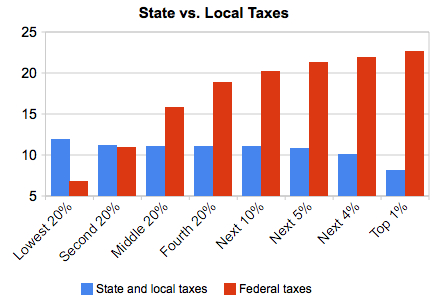

First, Sam Barr notes in his comment on my original post that it is unfair to focus on the income tax in isolation, since “[T]he FICA tax, property taxes, sales taxes, and excise taxes” are regressive.” We’ll begin with the FICA and excise taxes, since the other two Sam mentions are levied at the state and local level. As I have already mentioned, excise taxes, while regressive, accounted for only three percent of federal revenue in FY2008, and much of this was derived from taxes on alcohol, tobacco, and recreational goods. As I also noted, the FICA is levied on both employees and employers to fund Social Security and Medicare, from which employees receive direct monetary benefits during retirement. Since the bottom two quintiles actually profit from the federal income tax system, the only reason the red federal tax bars in Max’s graph do not extend below the x-axis for the “Lowest 20%” and “Second 20%” of income earners is because of payroll taxes, which directly fund the retirement of these same people.

Max correctly refutes my claim that “for nearly half of American households this year, April 15 will be no different from any other day,” since I failed to mention that I had been referring to federal taxes. Virtually all citizens, of course, pay state and local taxes, such as property taxes, sales taxes, and state-level income taxes. The first and most obvious response to this is that taxes vary tremendously from state to state and from locality to locality, meaning that, while the CBO’s “effective tax rate” might be accurate in some sense for the country as a whole, the overall rate is much more progressive in, say, Knoxville, Tennessee, than in New York City.

But the more salient (sorry) issue here is the notion that there is no important distinction between federal and state taxes, and that pointing out that 73 percent of federal income taxes are paid by the top 10 percent of income earners—never mind the effects of corporate and estate taxes—results from a “confusion between share of taxes being paid and tax rate.” While there may not be a significant economic distinction between federal and state taxes, this distinction is quite important in political terms, as is the proportion of federal taxes paid by various economic strata. It is quite reasonable to say that taxes should be levied according to citizens’ ability to pay, but it is also reasonable to point out that 47 percent of the country has virtually no stake in funding the U.S. military, benefits for veterans and federal retirees, federal support for education, transportation and infrastructure, and international affairs, and the numerous other areas of federal spending not directly tied to workers’ retirement welfare. Such programs are all benefit and no cost for the bottom 47 percent of the country, and very little cost for a great many more. Is it unreasonable to speculate that such voters go to the polls with far less concern about the deficit, or federal fiscal policy in general, than those who are footing the bill? Is it alarmist to suggest that a system in which so many citizens have little if any stake in the nation’s fiscal future is a recipe for disaster? One might argue that I am being too cynical about the way voters think, or that I simply misunderstand how voters go about choosing candidates, but this is anything but an illegitimate concern.

It is difficult for me to respond to Max’s arguments concerning economic justice given our seemingly irreconcilable definitions of this concept. I tend to approach the tax policy debate with the assumption, naïve though it may well be, that people generally have money because they earned it, and that, although there are few causes more important than helping the poor, this generally lies outside the domain of government. He is correct, however, when he says I imply “that taxes divide us”: they divide us politically in the sense that they require a very small proportion of citizens to fund what he terms the “American communal project,” or virtually every federal spending program outside Social Security and Medicare. Those who are legitimately unable to pay taxes (i.e., those living in poverty) should not be required to do so. But those who are not impoverished should have a non-negligible stake in the portion of federal spending that pays for the services enjoyed by the entire country. My hunch is that this would include more than 53 percent of Americans.

Photo Credit: Wikipedia.