The Great Tax Debate begins every year in the blogosphere around April 15th. On the line are normative claims, like whether and to what extent we should be distributing resources communally. But the facts are easy to get wrong too. So today I thought I’d lay out some factual correctives to Peyton’s exemplar of the Great Tax Debate form, “Robin Hood Strikes Again” before engaging in my own argument about whether, in fact, taxes are the eevvviiilll, un-American thing that they’re often made out to be. My claim: tax day should be a national holiday.

First, Peyton points out that “47 percent of Americans will pay no federal income taxes for FY2009, either because their incomes were too low, or they qualified for enough credits, deductions, and exemptions to eliminate their liability.” And from this he concludes that “for nearly half of American households this year, April 15 will be no different from any other day.”

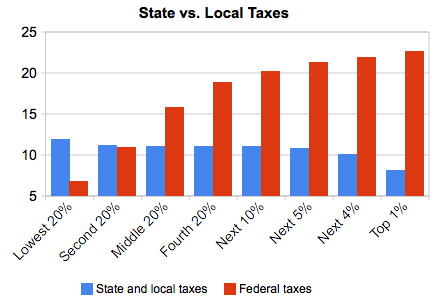

But this is simply untrue — and its untruth is telling and important. On April 15th, Americans pay Federal taxes and they also pay state and local taxes. While the federal tax bracket clearly tilts upwards, state taxes are not only less progressive, they’re often outrightly regressive. Consider this chart:

(from Ezra Klein)

So we should actually be looking at what the CBO calls the “effective tax rate,” which includes federal and state and local taxes. Considered in this way the tax distribution looks a hell of lot less progressive:

(from Citizens for Tax Justice, from the NYTimes)

Second, we have a confusion between share of taxes being paid and tax rate. Peyton points out that the top 10% of income earners pay 73% of the total share of income taxes. That seems unfair! But wait a second…if you make a lot of money — I mean, a real lot of money — then you’re going to be paying a lot taxes no matter what the tax structure looks like. Thus the fact that the top 10% pay 73% of the taxes could just as easily be an illustration of how unequal our society is as an illustration of how progressive (Robin Hood-like) our tax code is. In a world where (for example) there are only five people, if one person makes $1000 dollars and the rest make $10-$100, that first person’s share of the tax burden is going to be much higher than anyone else‘s regardless of how the tax system is structured (indeed even if it is regressive). And so it is in America, where the share of income inequality dwarfs tax rate inequality. As Ezra Klein writes: “Indeed, it’s only because the sheer levels of income inequality in this country are frankly unintuitive that [conservatives] can even write this sort of dreck. People hear that the top 20 percent pay almost 70 percent of the country’s income taxes and nod their head. That’s unfair! But it mainly seems unfair because people don’t know the top 20 percent accounts for almost 60 percent of the national income.” His chart comparing income share to tax rate is informative:

(from Ezra Klein)

Taken all together, what you have is people paying total taxes pretty commensurate to the amount that they are actually earning (despite Petyon’s deceptive numbers):

(from Ezra Klein)

Thus, the conservative argument that the rich pay too much in taxes, and that the poor don’t pay their fair share, is quite simply a misrepresentation of the facts. Our tax code is not “extremely” redistributionist in any commensensical way, where the wealthy give more than they take. In fact, the defining trend of the past forty years has been the explosive growth of pre-tax income for the rich and at the same time the systematic dismantling of their effective tax burdens. We’ve seen inequality expand, and the tools to counteract it diminish.

Here are tax rates from 2004 compared against 1960:

And here’s income share for the rich over time:

(from Thomas Piketty and Emmanuel Saez)

Peyton asks in his post: “What is the endgame?” In other words: How far does Obama want to go to “spread the wealth around”? The answer for the progressive is simply to note that America is today among the most unequal developed countries in the world (with a Geni coefficient about the same as China’s). Since the 1979, the amount of pretax income controled by the top 1% has nearly doubled, to levels not seen since the Gilded Age. This wasn’t caused by the tax bracket, and it’s definitely not — and should definitely not — be solved by it, but the fact is the rich are taking in more than what they are giving back (relative to before) and that this is inimical to many of our country’s strongest values, like democracy (which depends on cross-cutting similarities between people), and freedom (which depends on economic independence) and steady economic progress (which, historically, comes from long term investments in the welfare of people).

I use charts and figures here so as to keep the debate on the level of facts. But this debate is more than that. I personally think, with Cass Sunstein, that tax day should be a national holiday — a time to celebrate the fact that we have access to all these private goods only because they are backed up by this collective, communal good, the American government. Without taxes we wouldn’t have police departments, fire departments, or roads; we couldn’t know who owns what and we couldn’t protect it if we did; our free speech wouldn’t mean anything and our right to assemble, like the Tea Partiers’ rights, couldn’t be guaranteed. Peyton implies that taxes divide us; in fact, they do they opposite — they affirm our commitment to the American communal project, to the American national idea.

Thus it seems to me that the conservatives’ insistence on bemoaning April 15th every year is the very opposite of the patriotism that it pretends to be.