Residential income segregation—the separation of residents by income and the isolation of neighborhoods both very rich and very poor—perpetuates income inequality. And it’s on the rise in the United States.

Income segregation is both a cause and a consequence of income inequality. It’s a consequence in that economic inequality divides Americans into groups which then file into homogenous neighborhoods. But it’s also a cause because this segregation multiplies the fortunes of those who can afford high-quality neighborhoods while exacerbating the economic disadvantage of those who cannot.

For a number of reasons, the neighborhood in which individuals live influences their economic status. Most simply, important resources are better and more available in wealthier neighborhoods. Wealthier areas have more money to attract high-quality teachers, afford a low teacher-student ratio, and purchase high-quality books. Subsequently, a child in a wealthier area will most likely get a better public education. Beyond schools, wealthier neighborhoods are also more likely to have quality transportation systems, well-paying jobs, robust police forces, and public facilities like gyms and parks, all of which contribute to socioeconomic status.

Neighborhoods also exert a subtler influence on their residents. Individuals, particularly children, develop their expectations and norms from their immediate environment. Kids in low-income neighborhoods, for instance, face less exposure to highly-educated adults but greater exposure to crime and unemployment. These children thus lack role-models to demonstrate the possibility of college graduation and high earnings.

Combined, these neighborhood influences seriously inhibit the ability of those from poorer backgrounds to climb the economic ladder.

Already an overlooked issue, income segregation appears to be on the rise. Sociologists Kendra Bischoff and Sean Reardon found that income segregation had “grown rapidly” between 1970 and 2009. The researchers detect several determinants of income segregation trends, comparing cities through the United States and over time. They concluded that a city’s level of income segregation is determined most strongly by its level of income inequality, total population, average educational attainment level, and the proportion of children in the area.

All of these factors combined suggest that income segregation is rapidly accelerating in post-recession America.

Separated Financially, Separated Physically

Bischoff and Reardon found that changes in income inequality accounted for roughly 70 percent of changes in income segregation. The researchers also found that income segregation was particularly strong at the top—the richest families were much more likely to be isolated from other classes than were the poorest families.

Income inequality doesn’t necessarily imply income segregation. A city that evenly disperses its richer and poorer residents has income inequality but no income segregation. However, income inequality does appear to cause income segregation. As Americans become separated by income, they also become separated by neighborhood.

This relationship makes American income inequality all the more consequential. It’s no secret that American income inequality is high by international standards. In 2014, the United States had the fourth highest level of income inequality among advanced industrial nations, trailing only Mexico, Chile, and Turkey. And inequality in the United States is still rising. According to Lane Kenworhty and Timothy Smeeding, authors of the 2013 Gini country report for the United States, “income inequality in the United States has been rising, is rising, and in the future will also most likely increase.” A problem in and of itself, this is also concerning for its effects on income segregation.

The 2008 financial crisis only exacerbated income inequality in the U.S. Immediately following the Great Recession inequality actually decreased, mostly because the top one percent was hurt worst relative to pre-recession years. Between 2007 and 2009—the peak years of the recession—the one percent’s share of total national income fell from 23.5 to 18.1 percent. But while it’s standard for recessions to stall income inequality, recoveries almost always speed it up. Unless major policy changes are implemented in the aftermath of a recession to combat income concentration in the hands of the rich—as was done during the Great Depression—inequality grows predictably. Such policy changes were indeed enacted, including financial regulatory reform and a hike in the top marginal tax rate, but these changes were far weaker than those enacted after the Great Depression. Economists .

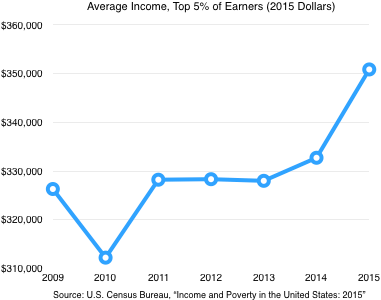

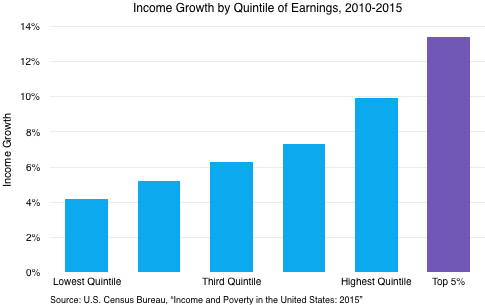

Post-recession numbers appear to corroborate that suspicion . The richest Americans have, predictably, managed to dominate the post-recession period. After dropping 4.3 percent between 2009 and 2010 alone, average income for the top 5 percent of earners rose 12.4 percent between 2010 and 2015. By comparison, average income gains for the bottom fifth of earners barely passed 4 percent over the same years. By 2011, American income inequality reached its worst level in recorded history. This matches the narrative of stagnating incomes for middle-class Americans amid bountiful gains for the richest of the rich. Additionally, the Trump administration has recently threatened reversals of post-recession financial regulation and tax cuts for the rich, which could have the effect of accelerating new growth in inequality.

The implications of growing income inequality on income segregation are immense. While income inequality slowed down a decade ago, it’s back on the rise. Unless recent trends reverse themselves and the Americans begin to reside in more economically diverse neighborhoods, it’s likely that we’ll start to see not only a growing disparity between the incomes of the rich and the poor, but a growing physical separation as well.

Growing, and Growing Apart

Observing 117 metropolitan areas with a population above 500,000, Bischoff and Reardon found that as population grew, so did income segregation. “Residential segregation is more possible in large metropolitan areas,” Reardon said in an interview with the HPR. “In smaller areas, there isn’t sufficient space or population to create as many spatially isolated, economically homogenous neighborhoods.”

However, average population size of large metropolitan areas only increased by 4 percent between 1970 to 2009. In recent years, metropolitan growth has picked up steam. Since 2000, the percentage of the population living in urban areas has increased by 3 percent—that’s equivalent to over 8 million people packing up and moving into the cities, or the creation of a new New York City. And while cities have been continuously growing, the rate of growth has only recently increased. Each year from 2010 to 2015, city population growth rates have exceeded one percent, more than doubling the average rate from the previous decade. The largest reason for the surge in city growth is migration to cities in the Sun Belt—the strip of land along the nation’s Southern border—where economic recovery has proven robust and stable.

Another significant demographic development is the growth of major cities relative to their surrounding suburban areas. Since the 1940s, suburbs have dominated American population growth, and their dominance continued through 2010. But in a total reversal of that long-lasting trend, cities grew faster than the suburbs from 2010 until 2015. That means Americans aren’t only moving from rural areas to metropolitan ones, they’re moving to progressively denser places. City growth has slowed down the past few years, but urban areas are still much more densely populated and growing much faster than they were at the start of this decade. And as people flood into the cities, it’s likely that they will continue to sort by income.

The demographics of the new city dwellers makes urban income segregation even more likely. College-educated millennials, particularly well-paid ones, have been the group most likely to take to the city this decade. This suggests rising income segregation will follow, because both the affluent and the highly-educated are more likely than those of any other economic status or education level to residentially isolate themselves.

Education and Segregation

With rising inequality in educational attainment levels comes rising residential income segregation—the reason for this, however, is unclear.

One explanation is that we simply prefer to live with those similar to ourselves. Despite the cliché that “opposites attract,” psychological studies consistently find that we are more inclined to form relationships with like-minded others. The level of one’s education is a very significant determinant of personality, so it’s likely that Americans prefer to live near those of similar educational attainment.

Residential segregation by educational attainment is also, to some extent, the result of a correlation between education and wealth. If income alone determined where Americans lived, they would end up sorting by education level because, on average, a better education means higher income.

Reardon noted that it is difficult to determine the causal impact of education on income segregation: “It may be more about preferences for community amenities, real or perceived” he says. “It may not be driven by preferences about one’s neighbors, per se.”

Whatever the reason, trends in higher education indicate a continuing rise of income segregation. The share of the American population with a college degree increased more than 150 percent over the years observed by Bischoff and Reardon, exacerbating the cultural divide between those with and without upper education. Since the onset of the recession, however, college enrollment has actually decreased, despite an increase in high school completion.

While this would typically inhibit income segregation growth, that may not be the case in the aftermath of the recession. People tend to stay in school longer during economic downturns, so while fewer Americans are entering college than they were during the recession, more educated individuals are looking for a place to live. And because educated individuals tend to isolate themselves residentially, this could lead to more segregation.

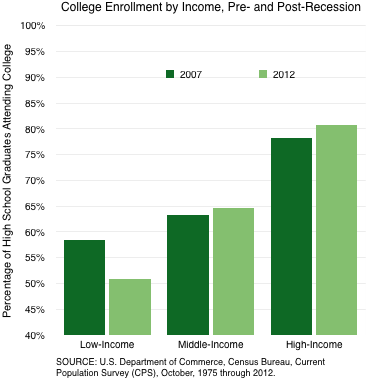

The second trend has to do with the demographics of college students. The price of higher education skyrocketed during the recession and has grown ever since, though at a decreasing rate. This turns education into a luxury only the rich can afford. In 2007, college enrollment for low-income high school graduates—those in the bottom fifth of family earnings—was at an all-time high: 58 percent were enrolled at a two- or four-year school. That number dropped during the recession, hitting 51 percent in 2012, the most recent year for which data is available. By contrast, enrollment rates for middle- and higher-income students rose during the recession, hitting 65 and 81 percent, respectively. Both wealth and educational attainment correlate with income segregation; increasing concentration of college enrollment to the well-off likely means increasing income segregation, and working- and middle-class Americans will be the ones to pay the price.

The Role of Children

Finally, for a given population, more children means more income segregation. Parents are more selective about the quality of their neighborhood than non-parents due to the influence of the residential environment on children. Children are taught standards, values, and expectations, such as the importance of higher education or the danger of drug usage, not only from their parents but from those living nearby. More directly, the quality of a community’s resources, such as its schools, parks, or transportations systems, are a result of the income of its residents and the taxes they are able to pay.

As a result, parents are willing to pay the price for expensive neighborhoods. Many of these neighborhoods, however, are only affordable for the rich. With income inequality increasing constantly, economic status plays an even greater role in determining the quality of a neighborhood parents can secure. “Research consistently shows that parents of all income and education levels value their children’s education highly,” Reardon said. “What differs is that high-income families have more resources, and therefore more options about where to live.”

The average proportion of large metropolitan populations under the age of 18 fell 10 percent from 1970 to 2009, slowing down the growth of income segregation over these years. And though fertility has, by some measures, hit an all-time low in recent years, we may see an increase in childbearing coming soon.

After rising to its highest point in two decades, the fertility rate dropped in 2008 owing largely to the recession. This is a predictable consequence of an economic downturn, but it is often followed by an increase in birth rates, according to a report from the Population Council. Fertility rates rose in 2015 for the first time since the start of the recession, hinting at the anticipated resurgence in childbearing.

Whether the Great Recession will be succeeded by a rise in fertility comparable to former economic turndowns remains to be seen. “It’s certainly taking longer than some experts expected,” said Gretchen Livingston, a Pew Research expert on fertility, in an interview with HPR. Her research shows the recession’s drop in fertility was driven primarily by declining birthrates among women under 30. This statistic comes as no surprise given women of this age were the most likely to admit intentionally delaying child-bearing during the recession, in large part because almost half of all young adults considered themselves to be hit hardest by the recession. If women of this age do end up having children as economic conditions improve, it will likely mean a rise in total fertility.

Unemployment is, perhaps unsurprisingly, tied with fertility rates—as workers find jobs, they’re more likely to begin having children. After reaching its highest level in decades in 2009, unemployment in the United States now rests at its lowest point of the century. Back at work, many Americans will likely begin or resume childbearing.

More children, Bischoff and Reardon show, means more income segregation. But current demographic trends in parenthood suggest an uptick in fertility could be particularly conducive to growing segregation. Pew Research shows that college-educated parents, those most likely to residentially segregate themselves, comprise a greater share of new mothers than ever before. Whether fertility rates rise or fall for the population as a whole, they are rising for the group most toxic to income segregation.

More specifically, highly-educated adults have seen a drop in childlessness. Children encourage income segregation by incentivizing parents to find the highest-quality neighborhood possible; the number of children a parent has is therefore less consequential for income segregation than whether a parent has any children at all. “Over the last 20 years, more or less, we’ve seen pretty notable drops in childlessness particularly for women who are college educated,” Livingston said. The case is more extreme for women with advanced degrees—since just 2011, the number of women with a master’s degree or more that are childless has dropped by a third, and childlessness over the same years has dropped by three-fourths among those with a medical degree or PhD.

Income segregation, which has been on the rise since the 1970s, appears only to be accelerating. The Great Recession rattled many of the trends tied to income segregation: the steady rise in income inequality, the mass urban migration, the disparity in access to higher education, and the potential for an uptick in fertility all signal red lights for those concerned about residential income diversity.

A rise in income segregation, too easily dismissed as a consequence and not a cause of inequality, will continue to divide Americans and obstruct equal opportunity. This is a concern for reasons beyond the evenness of residential life in the United States; it is a concern for those who wish to preserve the American ideal of a ladder that starts anywhere and leads to success.

Image credit: Wikimedia Commons/Susan Murray