Thursday, February 8, 2018, Sen. Rand Paul (R-KY) rose from his seat to speak against his own party’s budget bill. “The reason I’m here tonight,” he began, “is to put people on the spot … I want them to have to answer to people at home, [if] you were against President Obama’s deficits, how come you’re for Republican deficits? Is that not the very definition of hypocrisy?” Sen. Paul had just highlighted the least-talked-about social justice issue in America today—the national debt.

When Rep. Paul Ryan (R-WI) became the Speaker of the House in 2015, he had established himself as the poster-child of fiscal conservatism and the leader of the deficit hawks in Congress, calling for smaller government and an end to the deficit spending of the Obama era. The themes of big government getting bigger and a national debt spinning out of control paid big dividends for Republicans in the 2010 and 2014 midterm elections, and as late as 2016, Republicans were still attacking the Democrats for raising the deficit.

But by 2016, the Republicans, Speaker Ryan included, had begun to change their tune. Thanks in part to Republican pressure and in part to President Obama’s own desire to shrink the deficit after the end of Recession-era stimulus spending, the federal deficit shrank from $1.4 trillion in 2009 to $438 billion in 2015—far from ideal, but still a major improvement. However, Ryan’s first act as Speaker was to pass a budget which raised the deficit to nearly $600 billion for fiscal 2016, an increase of almost 50 percent. Last year the deficit rose even further, to $666 billion. This time, the Republicans have no Democratic culprit to blame—they have conveniently forgotten their promises to cut the deficit, and have instead raised the national debt by over $2 trillion in the past two years alone.

The outlook for 2018 is equally worrying. The budget which President Trump signed last week eliminates the same spending caps that the Republican-controlled Congress put in place during the Obama Administration to limit deficit spending. Eliminating these spending caps will allow the deficit to rise by another $300 billion this year and add $1.7 trillion to the national debt this decade.

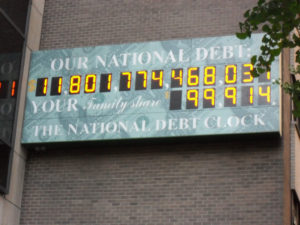

At the same time, the Republican tax cuts will also reduce federal tax revenue by about $1.5 trillion, adding even more to the deficit and the national debt. Many Republicans claim that their tax plan will “pay for itself” by promoting economic growth (and thus more tax revenue), but this is false by any objective measure. The nonpartisan Joint Committee on Taxation estimates that the tax cuts will cost more than $1 trillion even when accounting for economic growth, and the University of Pennsylvania’s Wharton School, where President Trump got his business degree, estimates that the cost will be closer to $1.4 trillion after growth. This fiscal carelessness will cause the national debt to skyrocket in the next decade: according to the nonpartisan Congressional Budget Office (CBO), the unbalanced budgets and massive tax cuts passed since President Trump took office will raise the national debt by $10-12 trillion by 2027.

Republicans may have decided to ignore the national debt, but as they themselves rightly pointed out when former President Obama was still in office, prolonged deficit spending has real costs. Every dollar of debt that the government accumulates will eventually have to be repaid, and just the interest on our current $20 trillion national debt alone already consumes 6 cents of every tax dollar. The tremendous cost of these interest payments is even more astonishing when one considers that for the past decade interest rates have been historically low, making all the money the government has borrowed since 2009 relatively cheap. The debt will continue to consume a larger and larger slice of the federal budgetary “pie”, until by 2026 it will cost taxpayers 12 cents of every dollar they send to the federal government—this figure could rise to as much as 21 cents by 2050 according to a 2015 CBO report.

The debt is not just a problem of “dollars and cents.” It is, first and foremost, a pressing threat to social justice. The government has very little flexibility in reducing mandatory spending on Social Security, Medicare, and non-discretionary defense spending. While these mandatory spending programs are in need of reform, it is unlikely—due to a combination of political obstacles, like restrictions on how Social Security tax revenue can be used—that they will be the first on the chopping block. As a result, the money needed to make interest payments on the debt will likely have to come out of the investments we make in education, health care, infrastructure, and so many other areas to ensure greater opportunity, and equality of opportunity, for the next generation.

Some claim that the country as a whole, and the individuals who receive benefits, would be better off if supposedly ineffective government programs were simply eliminated. In fact, ample evidence shows that this would not be the case. The strength of this small-government ideology in Washington in recent years means that the Americans who need help the most—our 20 million veterans, 2 million military servicemembers, and the 15 million children who live in poverty and hunger—will likely suffer the most from the deep cuts that will be necessary to avoid defaulting on our debt. In fact, the CBO estimates that within 5 years we will be spending more on servicing the debt than on education, scientific research, and infrastructure combined. Critical social welfare programs and economic investments funded by the Departments of Education, Housing and Urban Development, Veterans Affairs, Health and Human Services, and Agriculture would be cut. Valuable programs like the USDA’s school lunch program or Pell Grants will be gutted to service the debt.

There are certainly times when deficit spending is justifiable – for example, to prevent an economic depression, or to make critical investments for the future while interest rates are low. It is also undeniable that former President Obama and the Democrats added trillions to the debt. But especially for those with progressive political views, for those who think that America needs to look more towards the future than the past, the debt should be a serious concern. Skyrocketing debt will eventually lead to the evisceration of progressive priorities and government programs that promote social justice and equity. For progressives as well as conservatives, balancing the federal budget and reducing the debt should be a top priority.

This nation can get its fiscal ship back on course. Working together on a bipartisan basis, President Clinton and a Republican Congress turned a $255 billion deficit in 1993 into a $236 billion surplus by 2000. Even with the huge and unpredictable cost of the Afghanistan War, the entire national debt would have been paid off by 2015 if their responsible fiscal policies had been continued. That would have been the first time that the U.S. has had zero national debt since 1835, and we would have been better prepared to deal with the Great Recession and build a more equitable society for our children without bankrupting future generations.

The United States solved this problem once, and we must do it again. We have no other choice.

Image Source: Flickr/Rafiq Phillips